|

|

||||

|

||||

|

|

Press ReleaseHong Kong, 21st March 2024 Orient Overseas (International) Limited

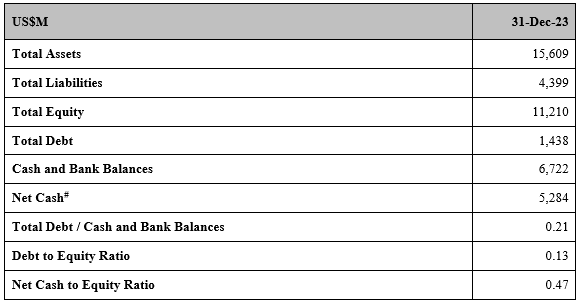

Balance Sheet Highlights

# Net cash represents cash and bank balances deducted by total debt. Details OOIL Financial Results – Full Year and Second Half of 2023

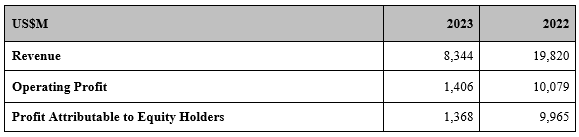

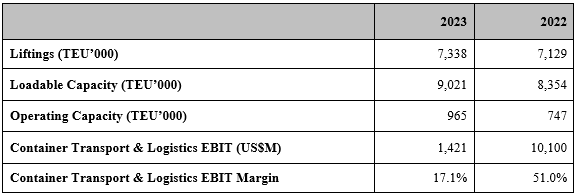

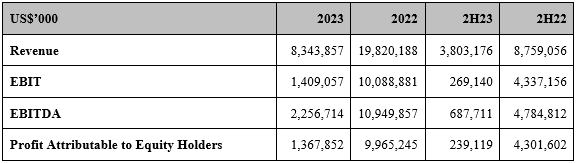

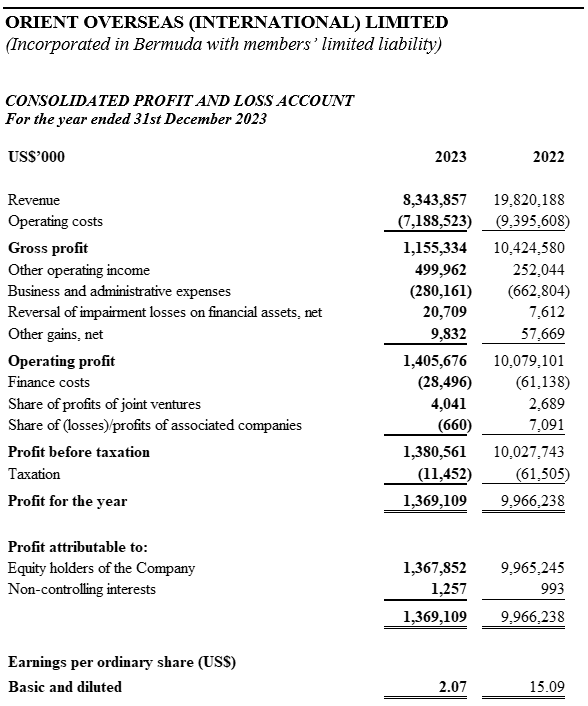

Earnings per ordinary share in 2023 was US$2.07, whereas earnings per ordinary share in 2022 was US$15.09. The Board of Directors has recommended that the dividend for full year 2023 is approximately 50% of the profit attributable to equity holders at approximately US$687 million, with proposed payment of a final dividend of US$0.145 per ordinary share and a second special dividend of US$0.036 per ordinary share for 2023. In order to optimise the capital structure of the Company and reflect our determination to reward the shareholders, the Board of Directors recommends the revision of the Dividend Policy so as to have a target annual dividend payout of 30% to 50% of the consolidated net profit attributed to the shareholders of the Company in the financial years of 2024, 2025 and 2026, whether as interim and/or final dividends, subject to, inter alia, the financial performance, liquidity position, future plans and working capital requirements of the Company and the prevailing economic, financial, business and regulatory circumstances.# # The declaration of dividends is subject to the sole discretion of the Board. There can be no assurance that dividends will be paid in any particular amount of any given period. The Dividend Policy shall not constitute a legally binding document in respect of future dividend declaration of the Company and/or in no way oblige the Company to declare a dividend at any time or from time to time. The distribution and payment of dividends of the Company will be subject to compliance with the Company's Bye-laws and applicable laws and regulations. The exceptionally robust container shipping market that we witnessed during the pandemic is now far behind us, and we have returned to a rather normal yet uncertain year 2023. The cargo demand recovery was not as strong as many anticipated, affected by high inflation, slowdown in economic growth of advanced economies, as well as the consumer spending patterns shifting in the post-pandemic. As carriers' schedule became more reliable, retailers opted towards a just-in-time approach when restocking, thereby delaying demand to a certain extent. On the supply side, with the alleviation of bottlenecks, and the continuous delivery of new ships, the change in supply has undoubtedly exceeded in demand and the continuous decline of freight rates. So far, we have taken delivery of 7 newly built 24,188 TEU container ships. The delivery of these new ships will not only help to increase the capacity and also realise the Group's endeavours to modernise its fleet from a technology and configuration standpoint, improving its cost-effectiveness and market competitiveness, help the Dual-Brand achieve the goal of maintaining its world's first echelon status and is also another proof of OOIL's commitment in energy conservation, carbon reduction, and environmental protection. Cooperation with fellow members of the COSCO SHIPPING Group and alliances helps to further expand OOIL's network, strengthen cost management capabilities, and contribute to the Group in increasing revenue and reducing expenditure. We believe the advantages of Dual Brand will continue to beneficial to the Group's future development. Despite the immense overall market pressure in 2023, our logistics company, OOCL Logistics, has made great progress in the field of dry cargo and cold chain transportation, achieving double-digit revenue growth. In the future, OOCL Logistics will continue to work closely with shipping companies to provide customers with a full range of high-quality services. This year, OOIL continues to be committed in promoting the digitalisation of the industry. We will take full advantage of using big data and AI to optimise the management of our boxes, ships and cargo, and improve customer satisfaction. IQAX, our wholly-owned IT company, has successfully launched electronic bills of lading (“eBL"). In early December 2023, the processing volume of eBL has exceeded 100,000. Relying on the FreightSmart and GSBN, we not only strengthened our relationships with our business partners, but also created more end-to-end digital solutions and expanded them to different countries and regions, improving customers' supply chain through the Group's platform with one-stop management experience. Looking ahead, the shipping market remains uncertain. The global economy seems to be recovering, but the pace may be slow and with uncertainties; interest rates on the other hand seem to have peaked, but remain hovering at high levels; the 2M alliance will be terminated, Gemini Corporation emerged, and Ocean Alliance announced further extension; geopolitical tensions and new environmental regulations, including the EU carbon tax, etc., have posed challenges to the entire supply chain. There is no doubt that all these will have a long-lasting impact on the future development of the shipping market. Since the beginning of 2024, the situation in the Red Sea is still one of the key factors affecting the container shipping market. With the tension in the Red Sea not being relieved, shipping companies will continue to navigate through the Cape of Good Hope in the coming months. In combination with the traditional peak season prior to Chinese New Year, freight rates have risen even more. However, the current supply chain tension is caused by the re-routing of vessels, which is quite different compared to the spike in demand, inadequate supply, and interruption of the supply chain during pandemic period between 2020 and 2022. It is difficult to predict what the changeable trend would be. What is obvious is that the container shipping market is highly susceptible to any form of major disruption; and the complete effect will not be seen until the original balance is restored or a new equilibrium is found. Regardless of the prospects, OOIL will continue to focus on being customer-centric, proactively and quickly respond to challenges, and provide high-quality services and green operations, as a Vital Link to World Trade. As at 31st December 2023, the Group had cash and bank balances of US$6,722.2 million compared with debt obligations of US$518.9 million repayable in 2024. The Group had a net cash to equity ratio of 0.47 : 1 as at end of 2023, compared with 0.68 : 1 at the end of 2022. The Group from time to time prepares and updates cashflow forecasts for asset acquisitions, to serve project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds. OOIL owns one of the world's largest international integrated container transport businesses which trades under the name “OOCL". With over 430 offices in approximately 90 countries/regions, the Group is one of Hong Kong's most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

* * * Issued by: Orient Overseas (International) Limited For further information contact Martin Kan Investor Relations (852) 2833 3143 Website: https://www.ooilgroup.com |

| | Help | Terms of Use | Privacy & Security | Online Security | | |||

|

|

Copyright © 1998- Orient Overseas Container Line Limited. All rights reserved. |

|

|