|

|

||||

|

||||

|

|

|

Press ReleasePress Release

Hong Kong, 13th March 2025 Orient Overseas (International) Limited Announces 2024 Full Year Results

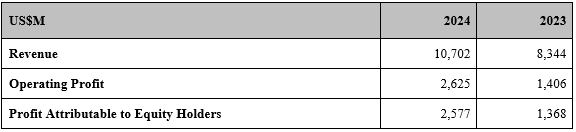

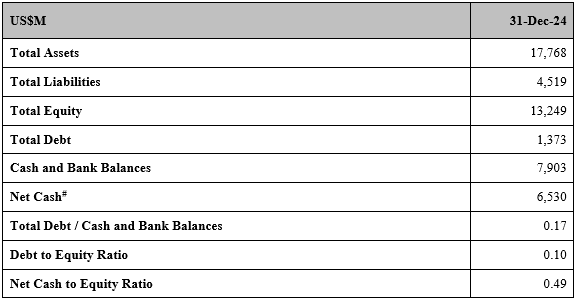

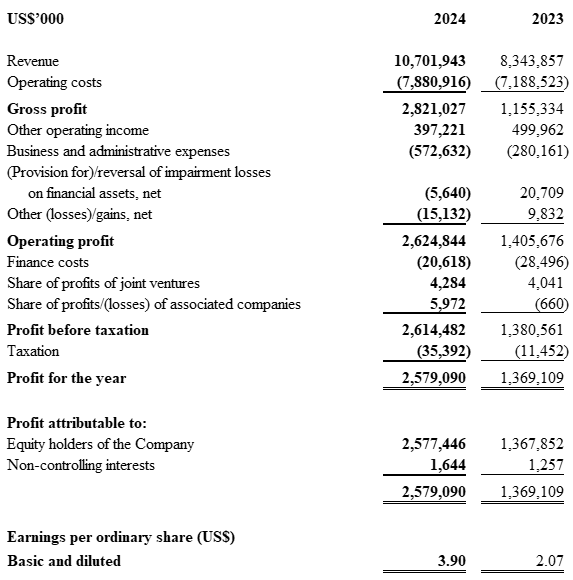

Balance Sheet Highlights

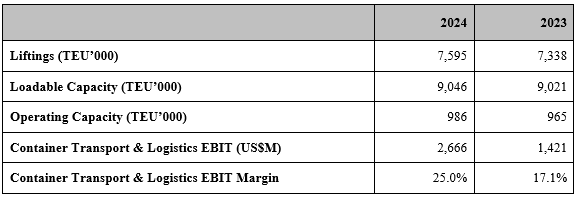

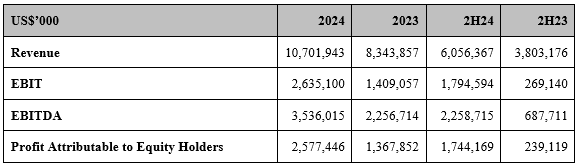

Details OOIL Financial Results – Full Year and Second Half of 2024 Orient Overseas (International) Limited (“OOIL") today announced a profit attributable to equity holders of US$2,577.4 million for 2024, compared to a profit of US$1,367.9 million in 2023. Earnings per ordinary share in 2024 was US$3.90, whereas earnings per ordinary share in 2023 was US$2.07. The Board of Directors has recommended that the dividend for full year 2024 is approximately 50% of the profit attributable to equity holders at approximately US$1,288 million, with proposed payment of a final dividend of US$1.32 per ordinary share for 2024. The final dividend will be payable in cash in either US dollars, Hong Kong dollars (converted according to the exchange rate of US$1 to HK$7.8) or Renminbi (converted at the average of middle exchange rate between US dollars and Renminbi as announced by the People's Bank of China for the 5 business days after the date and excluding the date of the annual general meeting of the Company). In 2024, the global economy gently continues its path towards recovery, with strong import demand from developed economies and rapid trade growth in emerging markets. The impact from the Red Sea situation had been felt in container shipping market throughout 2024. Geopolitical uncertainties not only shifted the dynamics between supply and demand for the entire industry but also affected people's expectations and behaviours. Industry's concerns regarding potential oversupply were temporarily subsided with the Cape of Good Hope detour absorbing some level of capacity. However, the detour caused other problems to surface. The unstable schedule at the beginning, as well as ongoing poor weather which disrupted port operations, caused congestion, and raised customers' concerns over the vulnerability of the supply chain and led to frontloading shipments which put further pressure on the supply chain. These interconnected factors helped push freight rates to a post-pandemic peak around the middle of the year, especially on the Trans-Pacific routes, which has attracted many new entrants. Their entry intensified market competition which in turn pushed rates down. However, due to the impact of the upcoming tariffs from the U.S. administration and the potential labour strikes along the U.S. East Coast and the Gulf, in combination with the cargo volume upsurge prior to Chinese Lunar New Year holidays, the market averted its traditional slack season. In recent years, we have embraced the new trends of green, low-carbon, and intelligent shipping industry development, actively promoting the modernisation of the fleet. The performance and configuration of our ships are increasingly aligned with future green and technological requirements. In 2024, we took delivery of six 24,188 TEU and one 16,828 TEU self-owned new container ships. Furthermore, we chartered-in six 13,000 TEU series brand-new container vessels which the first ones will begin operating earliest in 2026. These ships have good navigational capabilities and can be flexibly deployed to different routes. At a time when the shipyard orders are so full, this charter can ensure OOCL's fleet size will further grow, to seize development opportunities, and add flexibility to future capacity adjustments. We push to create a win-win scenario with our partners, through strengthening the synergy between our dual brands with COSCO SHIPPING Lines and maintaining close cooperation with other shipping companies in various ways, including slot exchanges, to maximise benefits. The smooth launch of Ocean Alliance's Day 9 products, especially the Asia-Europe routes via the Cape of Good Hope/Suez Canal, demonstrates that alliance members have the confidence and determination to respond to market changes and are prepared for them in advance. While reinforcing the liner business, we leverage upon our advantage and ability to provide full supply chain solutions, warehousing and distribution services as a logistics company and commit to build up the full supply chain with information technology and intelligence. Our supply chain products delivery ability has been continuously improved, and our end-to-end business has been further improved. In terms of the digitalisation, we further strengthen the fundamental capabilities of the digital supply chain and continue to enhance our value-added services to maintain competitiveness in the market and reinforce cooperation with all parties to foster the construction of an ecosystem for global trade. Looking ahead, the container shipping industry may face ever more challenges. Geopolitical uncertainties and changes in trade patterns will continue to bring challenges to supply chain management. Unbalanced economic development amongst different countries or regions and the emergence of structural risks will bring some degree of uncertainty to demand. Potential overcapacity may arise as new vessels are delivered, especially when Suez Canal reopens. At the same time, FuelEU Maritime takes effect from 2025, while the existing environmental regulatory requirements continue to be tightened, all of which may offset supply to a certain degree. The impact on supply chain resulting from a restructure of alliances is yet to be seen. These factors do not exist or function independently. They are interactively intertwined, adding to the complexity of the shipping market. The dynamics of the situation continues to evolve as we enter 2025. Firstly, consensus among the parties one week prior to the deadline has averted the labour strike along the U.S. East Coast and the Gulf. Secondly, there are signs of de-escalation for the situation in the Red Sea, where the potential resumption of passage through the Suez Canal will release capacity and lead to the rather normal levels in freight rates. Thirdly, the U.S. administration unravels their new policies impacting the global economy and supply chain in the short and long run. These impacts may be different, but their effects should not be underestimated. The reshaping of the global supply chain will undoubtedly affect the container shipping market in the long term. Although the outlook is full of uncertainties, with the support of the dual-brand strategy, we are well prepared to embrace opportunities and respond to challenges with highly efficient vessel utilisation and excellent cost control, as well as in an innovative, prudent and flexible manner. We will consistently fulfil our People, People, People and Customer-Oriented commitment, and offer high-quality services and reliable products to greenly and intelligently bridge world trade. As at 31st December 2024, the Group had cash and bank balances of US$7,903.5 million compared with debt obligations of US$561.6 million repayable in 2025. The Group had a net cash to equity ratio of 0.49 : 1 as at end of 2024, compared with 0.47 : 1 at the end of 2023. The Group from time to time prepares and updates cashflow forecasts for asset acquisitions, to serve project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds. OOIL owns one of the world's largest international integrated container transport businesses which trades under the name “OOCL". With over 430 offices in approximately 90 countries/regions, the Group is one of Hong Kong's most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

* * * Issued by: Orient Overseas (International) Limited For further information contact

ORIENT OVERSEAS (INTERNATIONAL) LIMITED (Incorporated in Bermuda with members' limited liability) CONSOLIDATED PROFIT AND LOSS ACCOUNT For the year ended 31st December 2024 |

| | Help | Terms of Use | Privacy & Security | Online Security | | |||

|

|

Copyright © 1998- Orient Overseas Container Line Limited. All rights reserved. |

|

|