|

|

||||

|

||||

|

|

|

Press ReleasePress Release

Hong Kong, 21st August 2025

Orient Overseas (International) Limited

Balance Sheet Highlights

# Net cash represents cash and bank balances deducted by total debt.

Details OOIL Financial Results – First Half of 2025

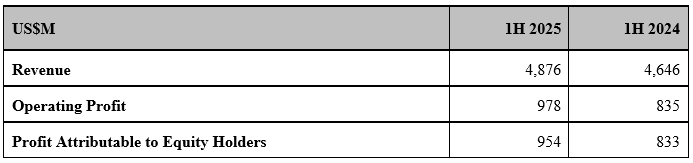

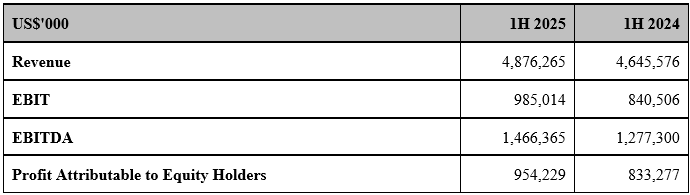

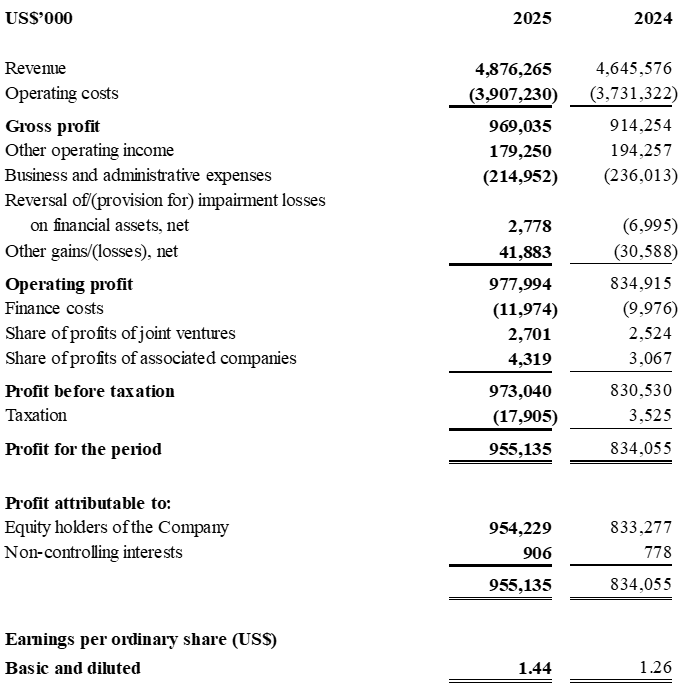

Orient Overseas (International) Limited (“OOIL") today announced a profit attributable to equity holders of US$954.2 million for the six-month period ended 30th June 2025, compared to a profit of US$833.3 million for the same period in 2024.

Earnings per ordinary share for the first half of 2025 was US$1.44, whereas earnings per ordinary share for the first half of 2024 was US$1.26.

The Board of Directors is pleased to announce that the dividend for the first half of 2025 is approximately 50% of the profit attributable to equity holders at approximately US$475 million, with an interim dividend of US$0.72 per ordinary share. The interim dividend will be payable in cash in US dollar or Hong Kong dollar (HK$5.616 converted at the exchange rate of US$1 to HK$7.8) or Renminbi (RMB5.138 converted at the exchange rate of US$1 to RMB7.1355, being the average of middle exchange rate between US dollar and Renminbi as announced by the People's Bank of China for the 5 business days before and excluding the date of Board meeting for, among other matters, considering the payment of the interim dividend).

Geopolitical uncertainties still significantly influence the shipping market. If the situation in the Red Sea was a defining factor which contributed to the strong performance of the container shipping market in 2024, then the ongoing changes in tariff policies and trade disputes have undoubtedly played a decisive role in shaping market trends in the first half of 2025.

Both the International Monetary Fund (“IMF") and the Organisation for Economic Co-operation and Development have lowered their forecasts for global economic growth in 2025 in the first half of this year, to 2.8% and 2.9% respectively. Then, at the end of July IMF raised its global growth forecast for 2025 to 3%, but the figure is still below the level it predicted at the beginning of the year and the one in 2023 and 2024. Frequent shifts in tariff policies have disrupted long-term planning, raised concerns among customers, and eroded both business and consumer confidence. This is especially evident on Trans-Pacific services, where freight rates have generally declined compared to the beginning of the year. While the 90-day tariff suspension between China and the U.S. led to a rapid recovery in freight rates from early-May lows, the rebound proved temporarily, with rates subsequently falling once more. Rapid capacity influx and the arrival of new competitors have significantly expanded overall capacity, while ongoing policy uncertainties have fuelled market concerns. As a result, many customers seem to have started to shift away from their precautious strategy of front-loading earlier this year to a more cautious, wait-and-see approach at present.

Despite the overall challenges facing the market, liftings in other trades have held up relatively well during this round of tariff changes. This resilience may be attributed to supply chain restructuring, varying economic conditions across regions, seasonalities, or port congestion. Additionally, the full impact of factors affecting Trans-Pacific routes may not yet have materialised. Regardless of the cause, the varied performance across different markets enables carriers to seize opportunities.

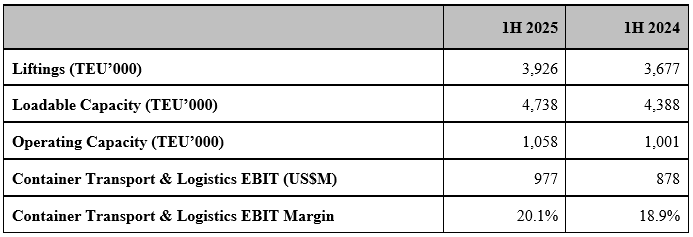

OOCL's total liftings for the first half of 2025 increased by 7% and total liner revenues increased by 4% year on year. Despite being only a single digit improvement, the year-on-year performance is the best post-pandemic period in terms of both liftings and liner revenue.

In the first half of 2025, average bunker price of OOCL was approximately US$541 per ton, an 8% decrease compared to US$589 per ton in the same period of 2024. This decline contributed to a reduction in total bunker cost. However, fuel oil and diesel oil consumption rose by 2% in the first half of 2025 compared to the corresponding period in 2024 which was largely due to expansion of fleet operating capacity.

We continue to strengthen our synergy with COSCO SHIPPING Lines in areas such as cost optimisation and risk diversification. This not only helps OOCL enhance its operational efficiency and market competitiveness, but also supports its global network deployment.

OOCL continues to grow its fleet in an orderly and rational manner, while optimising fleet composition. In the first half of 2025, we took delivery of five 16,828 TEU container vessels, marking an upgrade of our fleet on Trans-Pacific routes. We also placed an order for fourteen 18,500 TEU class methanol dual-fuel container vessels, once again demonstrating our Group's commitment to building a green fleet and supporting global energy conservation and emissions reduction.

For the first half of 2025, OOCL Logistics demonstrated resilient performance across its operations, navigating a complex global landscape while laying foundations for future growth. The overall supply chain environment during the period continued to be shaped by evolving market dynamics, including certain ongoing geopolitical considerations and adjustments within global trade patterns. Despite these broader market conditions, OOCL Logistics maintained a steady performance. Our international business continued to show positive momentum, benefiting from sustained demand for integrated logistics solutions and our ongoing efforts to enhance service offerings.

OOCL is committed to furthering the development of an end-to-end intelligent and digitalised supply chain. By offering customised solutions for international orders, origin management, warehousing, and distribution services, we effectively enhance the supply chain. We further integrate AI into our network planning, internal processes, and container and vessel management, enhancing both management efficiency and capabilities. Together with GSBN, we are promoting a digital ecosystem that brings together ports, terminals, logistics providers, and other stakeholders across the supply chain to build a digitalised supply chain environment.

At the time of writing this report, our vessels sailing on major long-haul routes are nearly fully loaded, and this is expected to continue in the coming weeks.

The trends in the first half of the year remind us that the shipping industry is highly dynamic and anything is possible. Ongoing policy uncertainties, developments in the Red Sea, continued delivery of new vessels, changes in the global economy, and gradually tightening of environmental regulations could all have profound impacts on overall market development. The additional port charges levied by the U.S. on Chinese carriers will have a relatively large impact on the Group. On the other hand, as global trade patterns shift to becoming more regional, market divergence may occur, or there may be delayed or deferred responses due to extended or restructured supply chains, all of which may be potentially creating opportunities for shipping companies to refine their strategies in segmented markets.

The Group will continue to uphold an innovative and adaptive business strategy to effectively respond to market changes, actively seize development opportunities, and maintain its industry-leading position. Through effective cost control, efficient and large-scale vessel operations, and intelligent and diversified network construction, we are steadily promoting our end-to-end business. At the same time, the Group continues to work with partners to promote green shipping, offer high-quality services to customers, create sustainable value for shareholders, and to greenly and intelligently bridge world trade.

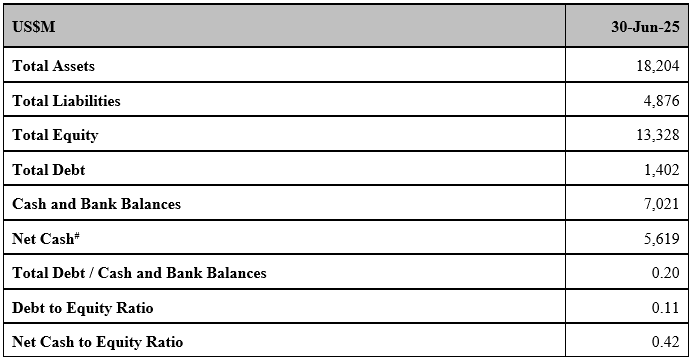

As at 30th June 2025, the Group had cash and bank balances of US$7,020.7 million compared with debt obligations of US$592.3 million repayable within one year. The Group remained at net cash position with a net cash to equity ratio of 0.42 : 1 as at 30th June 2025. The Group from time to time prepares and updates cashflow forecasts for asset acquisitions, to serve project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds.

OOIL owns one of the world's largest international integrated container transport businesses which trades under the name “OOCL". With over 430 offices in approximately 90 countries/regions, the Group is one of Hong Kong's most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited. * * * Issued by: Orient Overseas (International) Limited

For further information contact

ORIENT OVERSEAS (INTERNATIONAL) LIMITED (Incorporated in Bermuda with members' limited liability)

CONDENSED CONSOLIDATED PROFIT AND LOSS ACCOUNT (UNAUDITED) For the six months ended 30th June 2025

|

| | Help | Terms of Use | Privacy & Security | Online Security | | |||

|

|

Copyright © 1998- Orient Overseas Container Line Limited. All rights reserved. |

|

|